Is debt consolidation the best solution?

As a family, we have turned to debt consolidation on numerous occasions to sort out our finances. I don’t mind admitting that neither myself or my husband are great with money. That’s not to say that we’re materialistic, because we’re not really. Neither of us are accumulators of ‘stuff’. But travel and experiences are our weakness and often, debt consolidation ends up being our solution. So, I’ve been doing some research to see whether it really is the best idea.

What is debt consolidation?

Debt consolidation means taking out one loan to cover all your debts except for your mortgage. For example, if you have a car loan, two credit cards and a store card, you’ll be making multiple payments every month. Each one is likely to be accumulating interest at different rates and money comes out at different times.

Instead, you may wish to take out one loan to pay off all the amounts you owe. This would mean you still owe the same amount, but all those payments you were making would be consolidated into one. This may mean paying less interest in total and it could be that you end up paying less out each month. Additionally, you have the peace of mind of knowing that a single payment comes out at the same time each month. It may make it easier to budget for that, rather than putting aside sufficient funds to cover several different amounts.

Can debt consolidation be interest free?

Interest free debt consolidation may be an option for some people if you have a good credit rating. Instead of taking out a loan, you may be able to pay off your existing debts using an interest free offer on a credit card. That may mean taking advantage of an advertised offer for a new interest free credit card, or your existing card might offer an interest free period for balance transfers. Both options would be subject to a fee for the transaction which is usually a percentage of the money you are borrowing.

To consolidate debts using an interest free credit card, you’ll need to work out how much you can pay per month and whether you can pay off the full amount during the interest free period. If not, you would need to move the debt again to keep it interest free. You’d incur a further fee to move the debt again to another interest free card.

Is it worth taking out a debt consolidation loan?

If your debts are too large to consolidate onto an interest free credit card then a debt consolidation loan may be an option. Deciding whether this is the right debt solution for you will be a matter of both weighing up the pros and cons and doing the maths.

The loan available to you will largely depend on your credit rating. If your credit score is poor, high interest loans may be the only option. So ultimately, consolidating your loans could end up costing you more interest in the long run. It’s important to work out whether you’ll end up paying more interest or less, but also whether you can meet the repayments for the entirety of the loan. You may end up paying less per month but being tied to paying it for longer. For example, if this extends your repayment term to five years and you intend to retire or take maternity leave in three years, you could find yourself in a difficult situation.

How to deal with debts when debt consolidation isn’t an option

Sadly, it’s common to get to a point with where debt consolidation simply isn’t an option. This may be due to a poor credit rating, or simply because you are in too much debt to be able to fight your way out of it. This can cause an unimaginable amount of stress for the whole family, particularly if the threat of bankruptcy and losing your home is looming over you.

If you worry that you may be facing debts you can’t deal with, there is help out there. Whether there is a particular type of debt causing you a problem or you’re overwhelmed by the amount of it, head to this website for help and information. They have some great options and suggestions to put your mind at ease.

How to avoid getting into debt

It’s very easy to say that you should avoid borrowing money to avoid ending up in debt, but the reality is never quite so simple. Unless you have a savings pot to dip into in emergencies, borrowing can sometimes be the only way to make it to the end of the month.

The main lesson I’ve learned from making every mistake in the book is to put savings first. I don’t mean saving for a house or expensive car. I don’t even mean saving up to go on holiday. But having a pot set aside for emergencies is invaluable.

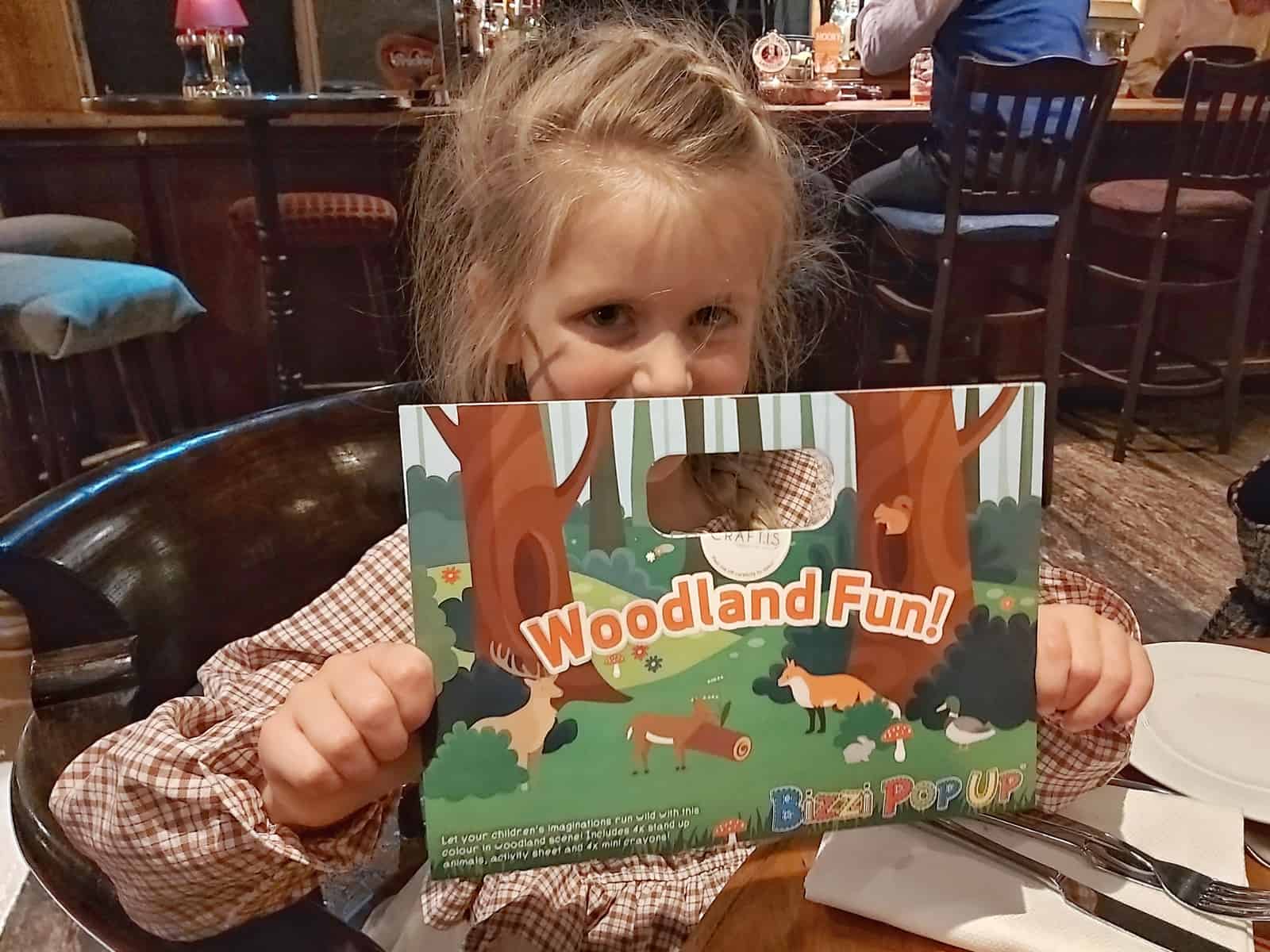

I started spending money on travelling as a teenager and never really stopped. Had I waited a couple of years, built up a savings pot for emergencies and then started putting aside money for holidays my life would have been a lot easier.

The other advice I’d give is to avoid over stretching yourself when you buy your first house. I bought my house in 2003. Little did I know that in 2019 I’d still be living here, unable to afford to get the house as I want it because I’ve spent all my adult life in debt as a result of poor financial choices and overspending on the house.

Whilst I have no regrets, I do intend to teach my children as much as I can about finances while they’re young. Because money won’t make you happy, but staying out of debt can make life a lot less stressful.

![The pros and cons of living in Narnia [AD]](https://plutoniumsox.com/wp-content/uploads/2020/03/narnia.-jpeg-scaled.jpeg)

![Planning an extension [AD]](https://plutoniumsox.com/wp-content/uploads/2020/03/20200326_173920-01-scaled.jpeg)