Insurance for small businesses

AD (Paid Collaboration)

As a small business owner, it is frightening to think how much could go wrong that you would end up liable for. Whilst paying out for things like insurance is never particularly appealing, it’s much better than the alternative. Should legal action be taken against you, the fees can end up being astronomical. It’s much better to make an investment early on and avoid that situation.

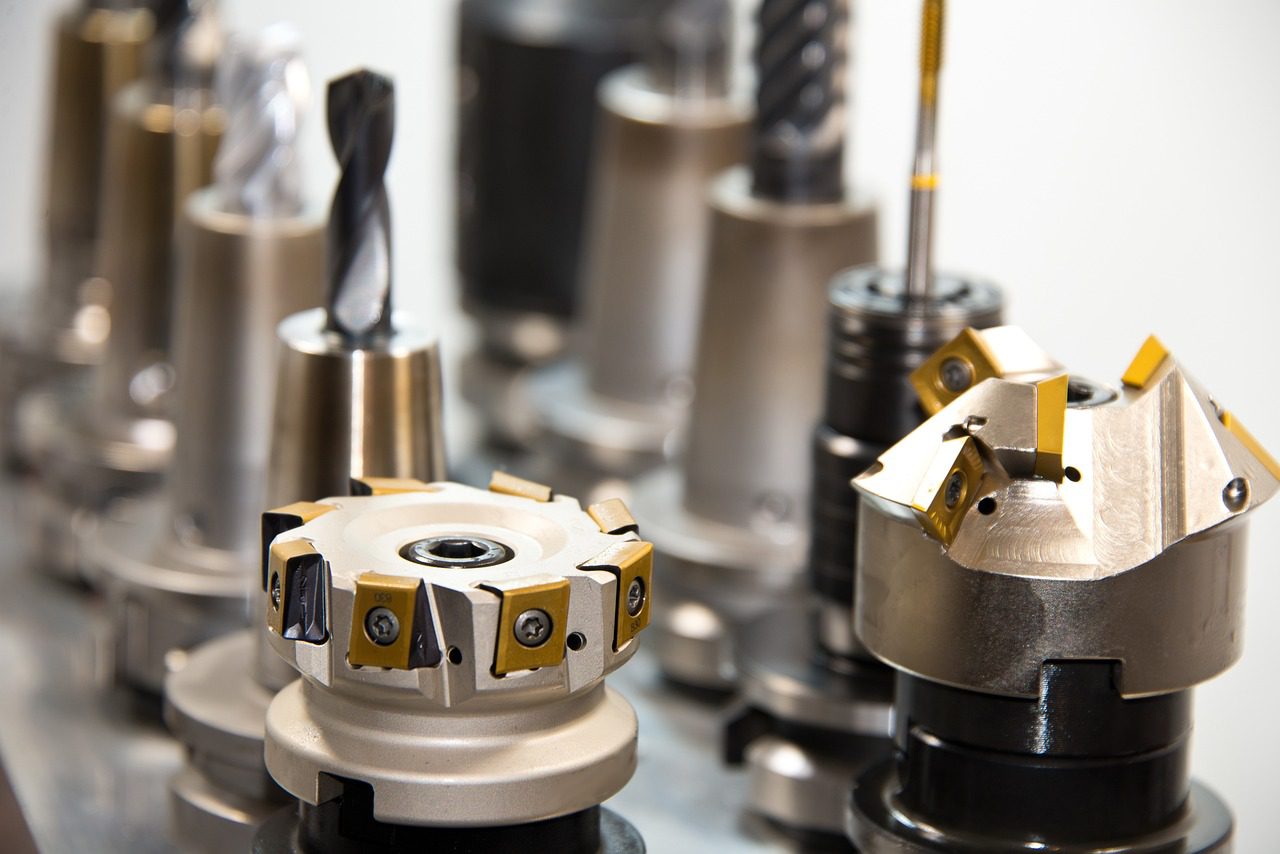

Trade insurance for small businesses

As a trades person, you need skills and experience that most people don’t have. That’s why they hire you, and without you there’s no way most people would cope with looking after their home or business. Whether you fix electrics, build walls, mend roofs or put up fences, we can’t do without you. But you probably didn’t go into the trade because you knew a lot about insurance.

Investing in an insurance for tradesman from day one means investing in peace of mind. Whilst you are probably extremely careful when it comes to both quality and safety, we all make mistakes and things do go wrong. In such a situation, you’d be vulnerable without insurance.

Insurance for other businesses

Did you know that there is probably a particular insurance type to cover you whatever your business does? For example, if you are a videographer, you’ll need to insure against losing those all important videos. But what about your equipment? Could you cover the cost if it went up in flames or got lost or damaged?

Whether you are an accountant, engineer, teacher or copywriter, you could still need insurance. The same goes for clubs and charities. For some sports clubs, being a member of the governing body will give you insurance cover. If you’re not sure though, it’s worth double checking. Interestingly I learned recently that if a club is liable for action taken against them then all of the members can be personally liable if there is no insurance in place. Not what you bargained for when joining a sports club is it?

Other insurance you’ll need as a small business owner

While you’re sorting out insurance for your business, it’s worth taking a moment to consider your personal situation as well. How would you cover your living costs if you were unable to work? That might happen through illness or injury to you or another person. If you don’t have a plan in place, it’s worth thinking about.

Additionally, life insurance should always be a consideration so you can provide for your family, even after you are gone. Whilst death isn’t something any of us want to think about, the alternative is far worse. Without life insurance in place, families face losing their home after a loved one dies. It just doesn’t bear thinking about.

Then there are pensions to consider. Do you have adequate financial plans in place for your own future? This is the one that bothers me at the moment, I certainly haven’t got a decent private pension to fall back on and it’s something I need to invest in more as time goes on.